Explain Different Continuation and Reversal Patterns

Bullish engulfing pattern. 1 trending vs retracement move 2 lower highs and higher lows 3 time factor.

:max_bytes(150000):strip_icc()/dotdash_Final_Continuation_Patterns_An_Introduction_Jul_2020-01-3545a8ca01b94663a186308a5d7a5c5f.jpg)

Continuation Patterns An Introduction

The three men never claimed to be the final word on Gann or Elliott or moving.

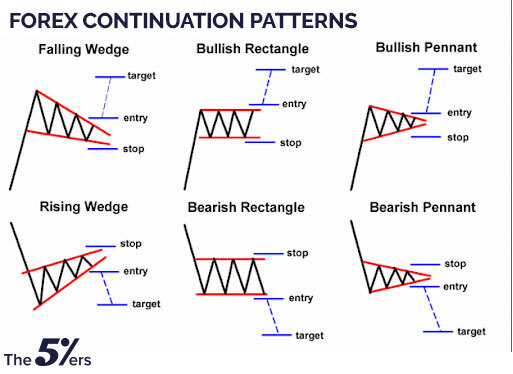

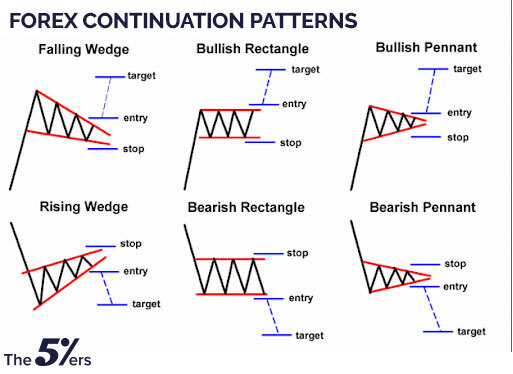

. This article will focus on the other six patterns. The Measured Move is a three-part formation that begins as a reversal pattern and resumes as a continuation pattern. Technical analysts have long used price patterns to examine current movements and forecast future market movements.

Hammer 1 Inverted Hammer 1 Morning Star 3 Bullish Abandoned Baby 3 The hammer and inverted hammer were covered in the article Introduction to Candlesticks. The first candle is bullish with a large body. Some common reversal chart patterns are the inverse head and shoulders ascending triangle and double bottom.

Measured Move - Bullish. First we will explain about reversal candlestick pattern from morning or evening star. The Island Reversal pattern is a reversal pattern that heralds a short-term change in the direction of the market trend.

This is supposed to explain why Trump fell in love with Kim Jong Un and praised other dictators. Because the Bearish Measured Move cannot be confirmed until after the consolidationretracement period it is categorized as a. Thats because this pattern appears within an uptrend which signals a reversal.

Morning star candle pattern is a bullish reversal candle. Some Continuation patterns are as follows. Every reversal chart pattern has 3 components to it.

A reversal pattern signals that the trend is about to reverse after the pattern has completed itself. The dark cloud cover is a two-candlestick pattern. The second candle should open below the low of the first candlestick low and close above its high.

The three types of triangle continuation patterns look different yet provide similar information. A continuation pattern occurs when the trend continues in its existing direction following a brief pause. Continuation patterns identify opportunities for you to continue with that trend weather is going up or down.

Well it is time to set the record straight. That concludes this session until next time and another session take care. Spinning top Identifying the Strongest Candlestick Reversal Patterns.

Schabacker Edwards and Magee are the authoritative sources on classical charting principles. Continuation patterns can be. Traders must consider the differences between Continuation Head and Shoulder with Reversal Head and Shoulder.

The two popular technical analysis patterns are known as reversals and continuations. The dark cloud cover is as ominous as it sounds. A technical analysis pattern that suggests a trend is exhibiting a temporary diversion in behavior and will eventually continue on.

The Penrose pattern is a tiling of two-dimensional and of three-dimensional space by identical tiles of two kinds acute and obtuse rhombi with α. Measured Move - Bearish. The Bearish Measured Move consists of a reversal decline consolidationretracement and continuation decline.

The reversal patterns are island reversal moving average crossover and head and shoulder formation. Bearish Candlesticks reversal patterns are. The first candlestick is bearish.

An uptrend which is a series of. When a price pattern signals a change in trend direction it is known as a reversal pattern. Just a quick refresher there are 2 main types of chart patterns continuation chart patterns and reversal chart patterns.

Note that we have classified these chart patterns by whether they are typically reversal or continuation patterns but many can indicate either a reversal or a continuation depending on the circumstances. The second candle is bearish and closes at almost the length of the first candle. They claim that such a pattern does not exist.

Bearish reversal patterns appear at the end of an uptrend and mean that the price will likely turn down. Broadening triangles are rare and often occur at reversal points and are therefore not classified as continuation patterns. Morning Evening Star Candlestick Patterns.

The continuation patterns are channels flags and pennants and trendlines. A number of readers have questioned the legitimacy of the continuation pattern. Reversal chart patterns can also be trend continuation patternsthe context is what matters.

A 2-candle pattern appears at the end of the downtrend. This pattern produces a strong reversal signal as the bullish price action completely engulfs the bearish one. A reversal is also referred to as a trend reversal a rally or a correction.

For a complete list of bullish and bearish reversal patterns see Greg Morris book Candlestick Charting Explained. A pattern is considered complete when the pattern has formed can be drawn and then breaks out of that pattern potentially continuing on with the former trend. Dark Cloud Cover Continuation Candlestick Patterns.

Continuation Correctional StructurePattern Bullish Bearish Flag Bullish Bearish Pennant Parallel Channel Reversal Correctional StructurePattern Ascending Descending Channel Rising Falling Wedge Double Top Bottom Head Shoulder PatternInverse H and S M and W style pattern Reversal Impulse Price Action I will forward all the price action. You can use chart patterns for day trading. A reversal is a change in the direction of a price trend which can be a positive or negative change against the prevailing trend.

Each pattern will be discussed thoroughly in future sessions. On a price chart reversals undergo a recognizable change in the price structure. It looks all fine on the drawing above but in real life it may not be as clear as that.

Continuation Head and Shoulder. Wed be looking for it in a down trend. A continuation pattern tells you the trend will continue once the pattern is complete.

Chart Patterns Vs Candlesticks Patterns The 5 Ers Forex Blog

Main Type Of Reversal Pattern Continuation Pattern And Bilateral Pattern In Forex Trading Trading Charts Stock Chart Patterns Technical Analysis Charts

/dotdash_INV_final-Continuation-Pattern_Feb_2021-01-95fbac627c854af09b03bc60e11dfca3.jpg)

Continuation Pattern Definition

What Are All The Reversal And Continuation Patterns Do You Know In Chart Reading Technical Analysis Stock Market Quora

No comments for "Explain Different Continuation and Reversal Patterns"

Post a Comment